Understanding the feasibility study of a property development project is vital to understanding whether or not the project is worth investing into.

At the most basic level, the purpose of a feasibility study is to evaluate the expected costs involved with undertaking a project compared to the expected revenues from completing it. This allows the developer to determine how much potential profit exists in the project.

The first step is to figure out what you’d like to build on the site, and then what sort of prices you could expect to sell it for once completed.

Then you need to add up all the costs that would be involved in actually building it: the cost of construction, acquiring the site, taxes, planning fees, consultant costs, and so on.

Once you have both of these figures, you can compare them and see how much profit the project should make. There are a few different metrics that you can use to measure the amount of profitability.

Net Profit

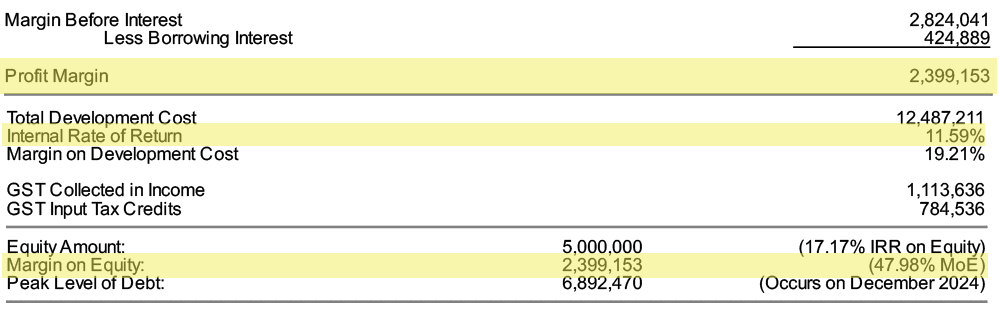

Obviously, there’s the net return as a dollar amount: exactly how much money will there be at the end. But only looking at the final dollar amount is simplistic. A profit of $1 million might sound like a lot without context, but it’s not actually a great return if you had to invest $10 million and the project took five years.

So you’ll also want to look at the return as a ratio compared to other factors, to make a better informed decision about whether or not the project is worth the time and money the developer would need to invest.

Margin on Equity

Margin on Equity (MoE) is the return, expressed as a percentage, compared to the amount of equity in the project. For example, if the project has $1 million in equity and makes a profit of $500,000, the MoE is 50 percent. This metric is useful because it basically represents the project’s return on investment.

Margin on Development Cost is similar to MoE, except it includes every cost related to undertaking the project, including debt. If the project cost $2 million total (equity + debt) with $500,000 of profit, the Margin on Development Cost is 25 percent.

Internal Rate of Return

The Internal Rate of Return (IRR) is a much more complicated calculation. To simplify, the IRR is basically the annualized return of the project, also expressed as a percentage. This is useful because it allows a developer to compare two projects that will take different amounts of time to complete. Looking at the IRR allows the developer to see which project is making more profit per year that it will take to complete.

To view the feasibility study for a specific project, you must enquire for the project. Check out the investment opportunities page to see what’s available.