History of the Australian Property Market

It’s a rule of thumb that Australian property prices can be expected to double every ten to twelve years. As noted by Abelson and Chung in their report for the Australian Economic Review, Australia underwent significant housing price booms in 1971-1974, 1979-1981, 1987-1989, and 1996-2003. There were minor corrections after each of these booms, but long-term rises outpaced the falls. Adjusted to compensate for inflation, real house prices rose by 180% between 1970 and 2003.

The Current Market

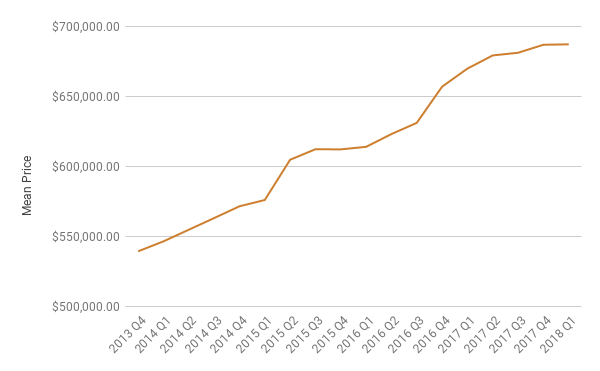

The Australian Bureau of Statistics maintains a Residential Property Price Index, which also lists the mean property price for the combined eight capital cities. We have provided this data from ABS on current Australian house prices below. However, the methodology for compiling the Index was changed in 2013, making the data incompatible with data obtained prior to 2013. As such, data prior to 2013 is not shown.

Market Factors

The growth of Australian property is affected by several factors which determine the supply of desirable land, the availability of finance, and the demand from property purchasers.

Investor Interest

Firstly, Australian property is bolstered by strong investor interest. As an investment, property significantly outperformed every other investment vehicle over a 20-year span from 1996. For example, the median price of a Melbourne house in 1996 was $131,000 (according to Abelson and Chung, 2003). By the end of 2016 the median price of a Melbourne property was $699,000 (ABS). This equates to a 21% increase per annum.

The investor market is itself driven by several factors which are supported by legislation. The two most prominent are negative gearing tax concessions and capital gains concessions.

Negative Gearing tax incentives of some form have been present in Australian Tax law since the Income Tax Assessment Act of 1936. Current legislation allows property losses arising from negative gearing to be claimed against other types of income with few limits or restrictions. Depreciation on an investment property can also be claimed based on effective life.

Investing in property is also encouraged by reductions to capital gains. In Australia, capital gains from investments are considered income and are subject to income tax. However, if the asset is held onto for one year or more the tax owed is reduced by 50%. So assets that are held for a longer duration, such as the traditional property buy-and-hold strategy, are more appealing than other asset classes which rely on short-duration but high-frequency. The introduction of the capital gains concession in September 1999 by the Howard Government coincides with the property boom of 2000-2003.

Low Land Supply

Despite being the sixth largest country by size with a surface area of 7,692,024 km2, Australia’s population is highly urbanised at 89% and clustered around the capital cities. In fact, according to the Australian Bureau of Statistics, 85% of the population live within 50 kilometres of the coastline. If you were to spread Australia’s population equally across the entire country, the population density would be 2.8 inhabitants per square kilometre.

Large areas of rural Australia are unable to secure loans from banks against the value of land in those areas, making it challenging to obtain the financing requirement to complete a rural development. Obtaining a loan in a rural area requires an acreage loan that is subject to different (usually stricter) lending criteria. In addition to this, Local and State level governments intentionally constrict land supply and require strict planning approval processes.

So despite having plenty of land, Australia has a low supply of desirable land that can be developed, and the Development process is too complicated for the average individual to reasonably undertake.

Social Security & Rent Support

Australia offers social security payments via the Centrelink Master Program, more commonly known as just Centrelink. Centrelink provides payments and services to retirees, the unemployed, families, the disabled, and many others. Those on Centrelink are eligible for additional payments up to $178 per fortnight to act as rental assistance. This rental assistance ensures that lower-income individuals and families are able to afford to rent and makes it easier for owners of investment properties to find tenants.

Low Interest Rates

In Australia, the target cash rate, which influences the market interest rate, is determined by the Reserve Bank of Australia. The RBA is the central bank and is responsible for issuing Australian currency. The RBA also has the responsibility of providing services to the Government of Australia and other banking institutions. The cash rate set by the RBA affects the interest rates offered by banks and lending institutions. A lower cash rate (generally) results in lower interest rates on mortgages. At the time of publication, the cash rate set by the RBA is at a record low 1.5%. This rate was first set in early 2016.